5301 10th Ave North, Greenacres, FL 33463

- Shoreline Financial Group

- Medicare Supplement

Medicare Supplement

Choosing a Medicare Supplement Plan

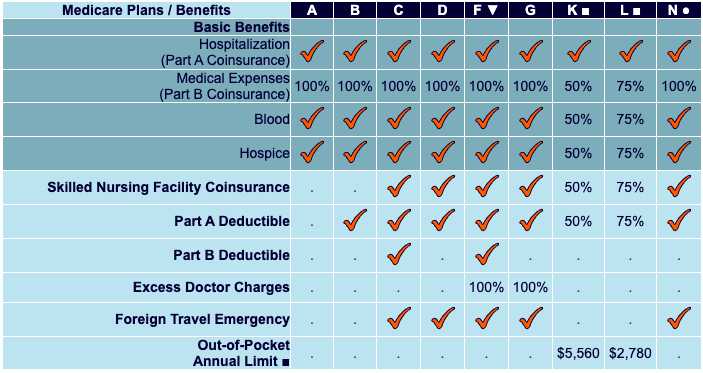

We offer Medicare Supplement policies for 10 of the 11 standardized plans A, B, C, D, F/HDF, G, K, L, and N (plan availability may vary by state). All Medicare Standardized plans include the following:

Basic Benefits:

- Hospitalization: Part A coinsurance plus coverage for 365 additional days after Medicare benefits end.

- Medical Expenses: Part B coinsurance (generally 20% of Medicare-approved expenses) or copayments for hospital outpatient services. Plans K, L, and N require insureds to pay a portion of the Part B coinsurance or copayment.

- Blood: First 3 pints of blood each year.

- Hospice: Part A coinsurance for eligible hospice/respite care expenses.

- See an outline of coverage for details and exceptions.

Plan F also has an option called a high deductible Plan F. This high deductible plan pays the same benefits as Plan F after one has paid a calendar‑year deductible. Benefits from high deductible Plan F begin after out‑of‑pocket expenses exceed the calendar‑year deductible ($2,300 in 2019). Out‑of‑pocket expenses for this deductible are expenses that are ordinarily paid by the policy. These expenses include the Medicare deductibles for Part A and Part B, but do not include the separate foreign travel emergency deductible.

Plan N pays 100% of Medical Expenses (Part B Coinsurance) except for a copayment of up to $20 for an office visit and up to $50 for an emergency room visit. The emergency room copayment is waived if the insured is admitted to any hospital, and the emergency visit is covered as a Medicare Part A expense.

Some states require designated Medicare Supplement plans also be available to people under age 65 and eligible for Medicare due to disability (different application forms may be required). Policy benefits are identical for people over or under age 65. Premiums are based on Preferred or Standard, age, sex, State/Area.

LEARN HOW OUR PRODUCTS WITH LIVING BENEFITS COULD GIVE YOU PEACE OF MIND!

Contact

-

-

5301 10th Ave North, Greenacres, FL 33463

Newsletter

Subscribe our newsletter to get our latest update & news.

Call to Our Experts

Shoreline Financial Group All Rights Reserved